The Benefits of Depreciating Fixed Assets

Assetbots Team

If your company has expensive equipment, tools or machinery, you should consider whether depreciating these assets would have financial advantages for you. For example, if you depreciate assets, you can generate tax deductions and defer tax payments for your company. This could amount to savings of thousands of dollars. Additionally, recording the depreciation of your fixed assets is important for preparing accurate balance sheets and tax reports.

Below, we explain how depreciation works, why companies depreciate their assets, and the most common methods used to calculate depreciation.

What is a Fixed Asset?

The equipment, tools, and machinery that a company owns for a long period of time and which help generate income are considered “fixed assets.” These assets lose value over time, even while continuing to provide a benefit to the company. Companies can depreciate the value of these assets to account for wear and tear during their useful life.

To calculate depreciation for your fixed assets, you must track the following information:

- Purchase date or date in service

When was the asset purchased or put into service? - Cost

How much did the asset cost? - Useful life

How long (in years) do you expect the asset to be useful? - Salvage value

How much can you re-sell the asset for when it reaches the end of its useful life?

What is Depreciation?

Depreciation is an accounting method used to allocate the cost of a fixed asset over its lifetime. This allows a company to write off the asset's value over its useful life, rather than all at once during the year it is purchased.

Deprecation represents an asset’s value after being used for some time and ties the cost of using an asset with the benefit gained over its useful life. By depreciating assets, a company can spread out the cost of the asset and tie depreciation expenses to related revenues in the same reporting period. The depreciation charges reduce the company’s taxable income, which then decreases its tax liability.

When you depreciate assets over a shorter period of time with higher depreciation expenses, you receive higher tax benefits and are incentivized to replace assets faster.

How Does Depreciation Work?

Let’s say a company has purchased a machine for $50,000. The machine has a ten-year useful life and can be scrapped at the end of its useful life for $10,000 (its salvage value).

When the machine is purchased the company has two options: it can expense the entire cost of the machine in year one, or it can write off the machine’s value over its 10-year useful life. Expensing only a portion of the machine’s cost can boost net income, which is why this option is preferred by most business owners.

Let’s assume the company decides to depreciate the machine. The company’s accountant calculates the depreciation expense as the difference between the machine’s cost and its salvage value, divided by its lifespan: ($50,000 - $10,000) / 10. This amounts to a depreciation expense of $4,000 each year. This depreciation expense is a tax deduction.

The accountant is able to expense $4,000 against net income that first year, and will continue to expense $4,000 for that machine for each year of its useful life until it reaches its $10,000 salvage value.

What are the Most Common Methods of Depreciation?

There are many different methods that can be used to depreciate fixed assets. Some commonly-used methods include straight-line, declining balance, and sum-of the years’ digits. Companies may choose which depreciation method to use based on how much depreciation expenses they would like to charge each year against their revenue for that year. Some assets naturally depreciate faster at the beinning of their life than at the end, and it may be preferrable for their depreciation schedule to reflect that fact.

Straight-Line Depreciation

The straight-line method is the most basic way to record depreciation. The straight-line method calculates depreciation by dividing the depreciable amount of the asset (i.e., the cost of the asset minus its salvage value) by the number of years of its useful life. For example, if you purchase a server for $5,000 that has a salvage value of $1,000, then its depreciable amount is $4,000. If you estimate that the server will have a lifespan of five years, then you would divide the depreciable amount by its lifespan: $4,000 / 5. This amounts to $800 in depreciation each year and a depreciation rate of 20%.

| Year | Opening | Amount | Closing | Rate |

|---|---|---|---|---|

| 1 | $5,000 | $800 | $4,200 | 20% |

| 2 | $4,200 | $800 | $3,400 | 20% |

| 3 | $3,400 | $800 | $2,600 | 20% |

| 4 | $2,600 | $800 | $1,800 | 20% |

| 5 | $1,800 | $800 | $1,000 | 20% |

Declining Balance

Declining balance is an accelerated depreciation method. With this method, equipment is depreciated at its straight-line depreciation rate, multiplied by its remaining depreciable amount each year. This results in a higher depreciation expense amount in the earlier life of the asset, with the amount declining in each subsequent year. Using this method more accurately reflects that many assets depreciate more quickly in their first years of life.

Declining balance is combined with a factor or multiplier that determines how much faster assets start depreciating compared to the straight-line method. The most common factors are 2 and 4 (i.e., twice as fast or four times as fast). When the factor is 2, the method is referred to as double-declining balance.

For example, if we use the $5,000 server from above with a straight-line depreciation rate of 20% over a five-year lifespan, then its double-declining depreciation schedule would look like this:

| Year | Opening | Amount | Closing | Rate |

|---|---|---|---|---|

| 1 | $5,000 | $2,000 | $3,000 | 40% |

| 2 | $3,000 | $1,200 | $1,800 | 40% |

| 3 | $1,800 | $720 | $1,080 | 40% |

| 4 | $1,080 | $80 | $1,000 | 7% |

| 5 | $1,000 | $0 | $1,000 | 0% |

There are two important things to note about declining-balance depreciation:

- The

rateis multiplied by the opening book value, not the total depreciable value like it is with the straight-line method - Depreciation stops when the closing book value has reached the salvage value, even if there is still time left on the depreciation schedule

Sum of the Years’ Digits

Sum of the years’ digits is another accelerated depreciation method. It can be thought of as a cross between the straight-line method and the declining balance method. In this method, the rate changes from year to year, but it is multiplied against the total depreciable value each time.

There are two steps to calculating the rate for sum of the years' digits depreciation:

- Calculate the denominator, which is the same each year and equals the nth triangular number (i.e., sum of digits), where

nis the length of the depreciation schedule. So, if the depreciation schedule is 5 years long, the denominator is1 + 2 + 3 + 4 + 5 = 15, orn(n + 1) / 2. - Calculate the numerator for the specific year:

5in year 1,4in year 2, all the way down to1. The multiplier for the year is then the quotient of these two calculations:5 / 15for year 1,4 / 15for year 2, etc.

| Year | Opening | Amount | Closing | Rate |

|---|---|---|---|---|

| 1 | $5,000 | $1,333 | $3,667 | 33% |

| 2 | $3,667 | $1,067 | $2,600 | 27% |

| 3 | $2,600 | $800 | $1,800 | 20% |

| 4 | $1,800 | $533 | $1,267 | 13% |

| 5 | $1,267 | $267 | $1,000 | 7% |

How to Get Started Depreciating Assets

If you are not depreciating your assets, you could be leaving money on the table. If you want to learn more about which assets you can depreciate and which depreciation method is most beneficial to you, you should speak with an accountant.

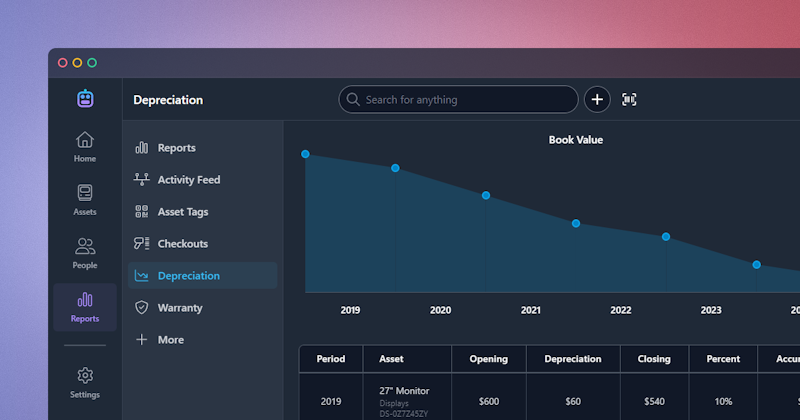

Once you understand which assets to depreciate and which methods to use, Assetbots is easy-to-use asset tracking software that will help you:

- Track data about your assets that is needed to calculate depreciation

- Calculate depreciation of your assets using the straight-line method, double-declining balance method, or sum of the years’ digits method

- Run detailed depreciation reports on your assets for visualization and monthly or quarterly book entries

Please open a ticket within your Assetbots account if you need help getting started or have questions about setting up your assets for depreciation. Happy tracking!