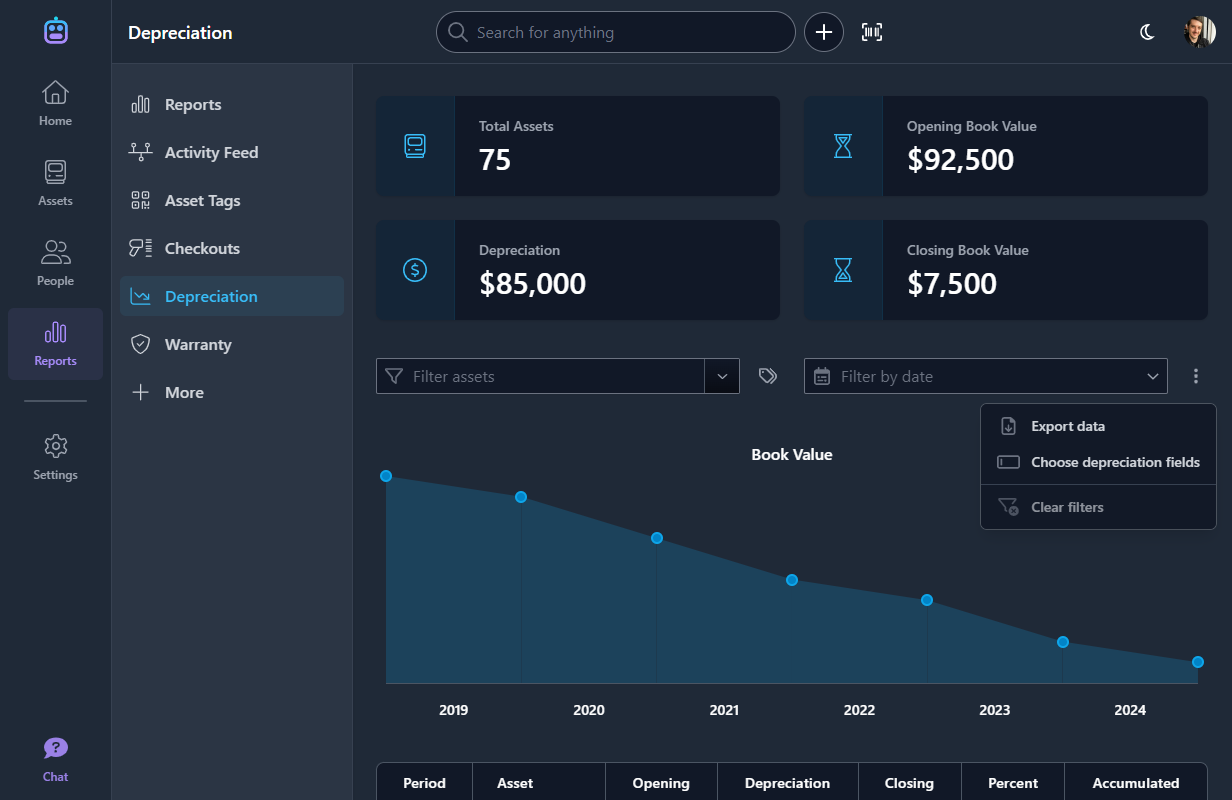

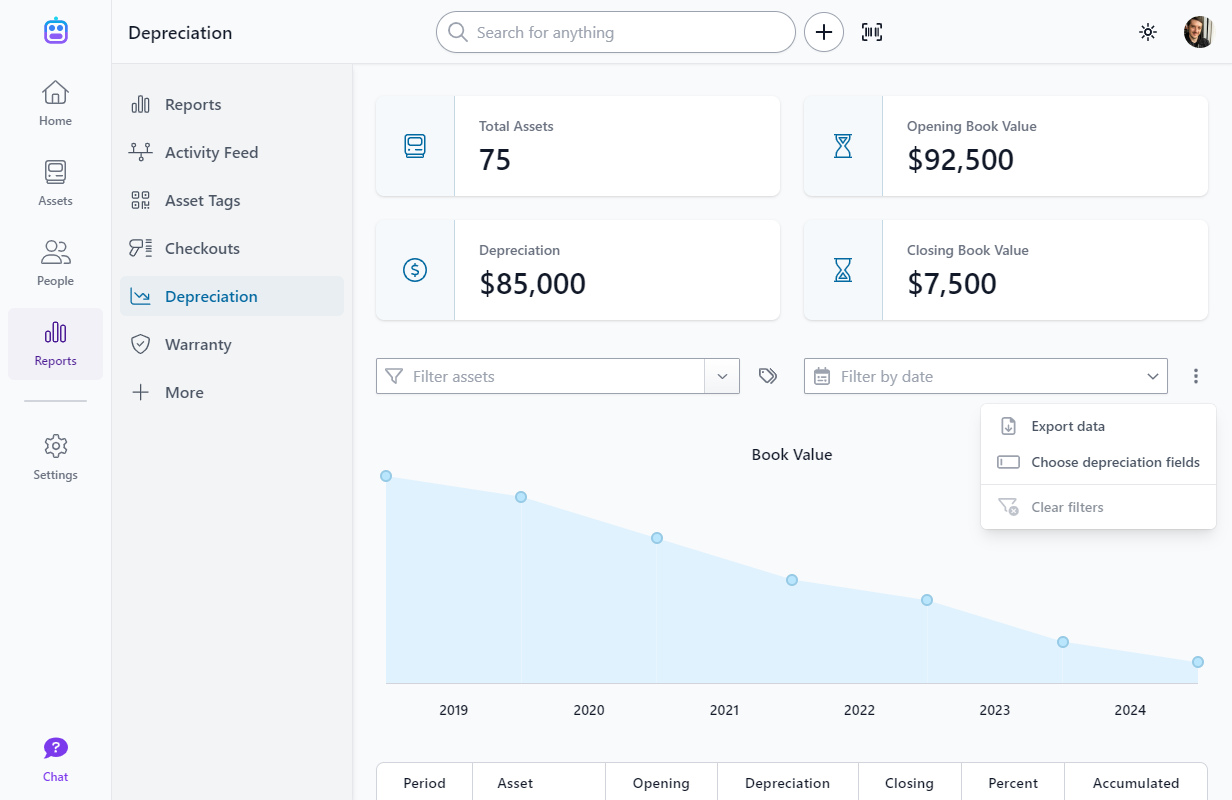

Depreciation Report

New Feature

Easily calculate the depreciation of your assets over time. This report helps you (or your accounting team) keep track of the value of your assets over their useful life, as well as calculate monthly or quarterly depreciation entries for your books.

The report is very powerful, and lets you mix and match depreciation methods per asset (choose from Double Declining Balance, Sum of Years' Digits, or Straight Line). You can customize which asset fields the report pulls values from for its calculations, as well as use your saved filters to select exactly which assets to report on.

Finally, set a date range (for example, This month or Last month) and export the data to Excel or CSV for importing into your accounting software.

Happy tracking!